My reason for applying is to “acquire knowledge and skills on how to invest the little money I earn from farming and gain more profit,” wrote an applicant.

While another wrote: “to acquire knowledge to sharpen my budgeting skills so I can help my team meet targets more efficiently and derive better financial outcomes.”

And so it is that our 2026 training calendar has kicked off with the Financial Management Training Course under the Training of Self-Reliant Participatory Development (SRPD) Change Agents Component, of our Dr. Paul Hargrave Memorial Centre Human Development Project, which we are jointly implementing with Canadian Physicians for Aid and Relief (CPAR).

CLICK HERE to learn more about our Dr. Paul Hargrave Memorial Centre Human Development Project

Applicants

We selected and invited 33 applicants, of whom 55% are male and 45% are female, to benefit from this residential training course now ongoing at our Dr. Paul Hargrave Memorial Centre in Lira City, starting from the evening of Sunday, 18th January to the morning of Saturday, 31st January.

According to data from their application forms:

- 82% are youth aged below 40 years; and of whom six are younger than 20 years – the youngest two are aged 17 years.

- 73% identify of Lango descent; and the others: 9% of Kumam, 9% of Iteso, 3% of Karamojong, 3% of Bugisu and 3% of Tooro.

- 33% are residents of Lira District; while the others, 21% are residents of Kole District, 21% of Otuke District, 9% of Alebtong District, 6% of Pallisa District, 3% of Apac District, 3% of Abim District and 3% of Wakiso District.

- 55% have never married and are unmarried; 42% are married; and 3% were once married, but are now divorced.

- 100% are multi-lingual – in addition to being endowed with English language skills, 82% speak and are fluent in Lango, 15% in Luganda, 12% in Ateso, 6% in Kumam, 6% in Swahili, 3% in Acholi, 3% in Lugwere, 3% in NgaKarimojong, 3% in Lugisu and 3% in Rutooro.

- 100% have had formal schooling at Primary School level. In addition, 67% have had formal schooling at Secondary School Level; 30% at tertiary certificate level; 12% at tertiary diploma level; and 9% at university degree level.

- 76% derive livelihoods from farming; 45% from businesses; and 15% from being employed by entities that are not of government; and 3% are employed in a government entity.

- Their expectations from the training course, include: to acquire financial management skills; planning, budgeting and business planning skills; knowledge to attain better financial outcomes; better manage, use and handle income, finances and money; better manage expenses; financial decision-making, invest money and get profit; earn money; and get a job.

Trainees

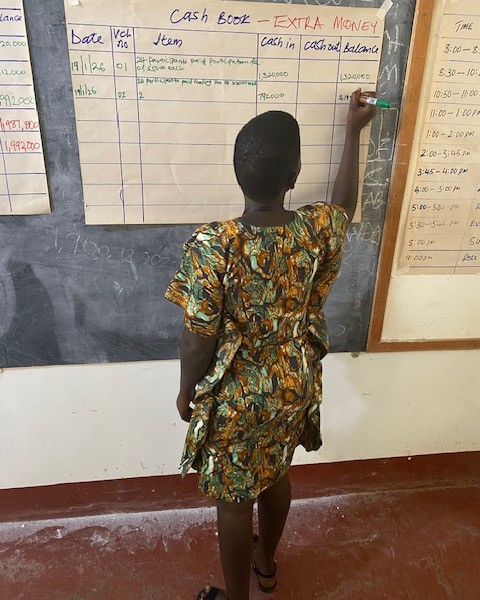

Learner Awor demonstrates her mastery of Cash Book Accounting

Learner Awor demonstrates her mastery of Cash Book Accounting

Twenty-two applicants reported and are now trainees in session. They have completed the first week of their two-week residential training course. Initial feedback indicates that we will have a high retention and completion rate.

Eleven applicants who were offered places in the training did not report for the training.

- Some called us to inform us that they were not able to travel away from their homes, in fear of leaving their homes due to post election violence in their home areas, specifically in Pallisa District in Bukedi Sub-Region.

- One of them we were unable to reach on the phone, considering our communication was now reduced to voice telephone calls only since the internet was shut down.

This training opportunity was made possible by a legacy grant from kin of the late Dr. Paul Hargrave, for which we are eternally grateful.

Leave a reply to Thank you DFCU Bank – CPAR Uganda Cancel reply